General banking requirements

Phase I review

- Certificate of Incorporation

- Trade and Business License

- Memorandum and Articles of Association

- Registers of Directors, Officers, and Members

- Bank Application Form

- Projected Financial Statements or Business Plan

Phase II review

- Share Register – Documents required to be certified as per our certification guidelines attached.

- Trade & Business License – Please note this document is required to be certified as per our certification guidelines attached.

- Management Accounts – Please provide a copy of the accounts, attested by a director.

- Cheque Book – Please confirm the following information if you would like to request for cheque book.

- Passport – Please note the documents is required to be certified as per our certification guidelines attached.

- Utility Bill – Please note this document is required to be certified as per our certification guidelines attached.

- Work Permit – Please note this document is required to be certified as per our certification guidelines attached.

- Source of Wealth & Source of Funds – Please include verification documents.

- Declaration of Tax Status Form – A document will be provided by the financial institution. Also, please provide a pdf passport copy for any other nationality held.

- What are the expected debits and credits to the account (to/from whom). Provide the type of transaction (cash, wire, cheques etc.) Be as detailed as possible identifying the purpose and origin of credits and destination of funds. NOTE: Ensure that this information provided on the application matches the financials in the business plan.

(a) Aggregate value of anticipated debits and credits per month.

(b) Aggregate value of cash transactions per month.

(c) Aggregate value of anticipated wires

Phase III review (eCommerce or Merchant Account)

- A merchant must be a customer of bank and have a physical presence in the country they are to which they are applying.

- A copy of the business plan to enable us to understand the full purpose or use of the merchant account.

- A chargeback reserve might be required; this is assessed on a case-to-case basis.

Website requirements:

- Complete description of the goods and services offered.

- Return and refund policy.

- Customer service contact including electronic mail addresses and telephone number.

- Delivery Policy.

- Credit Card logos.

- Completed Bank eCommerce Application Form(s)

Derik Feher (CEO)

Contact Me For More Information!

Phone: +1 (345) 922-5628

Email: derik@gatewayglobalsolutions.com

Banks We Work With

Note that we provide our services to all Canadian banks who process through Fiserv!

COUNTRY

BANK

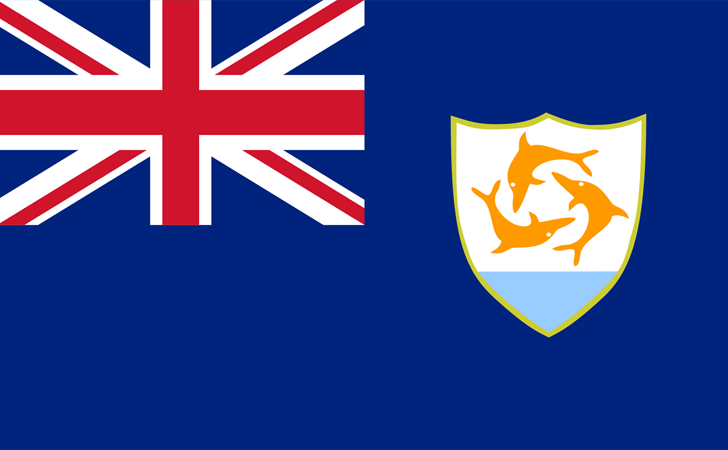

Anguilla

Anguilla Scotiabank

Scotiabank Antigua

Antigua Scotiabank

Scotiabank Aruba

Aruba MCB

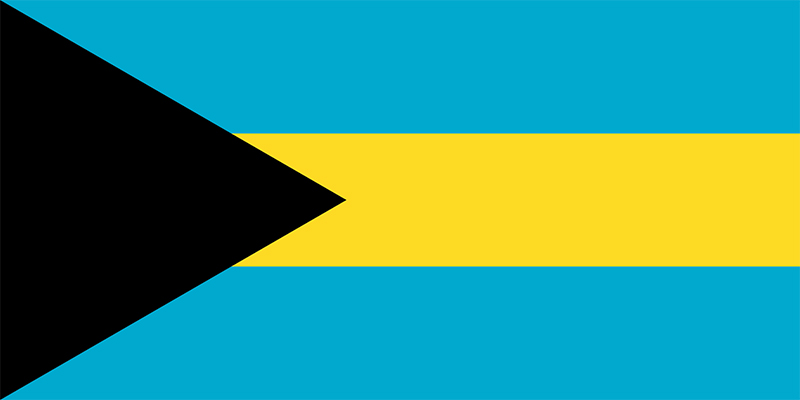

MCB Bahamas

Bahamas Scotiabank

Scotiabank Barbados

Barbados FCB

FCB Barbados

Barbados Scotiabank

Scotiabank Belize

Belize Scotiabank

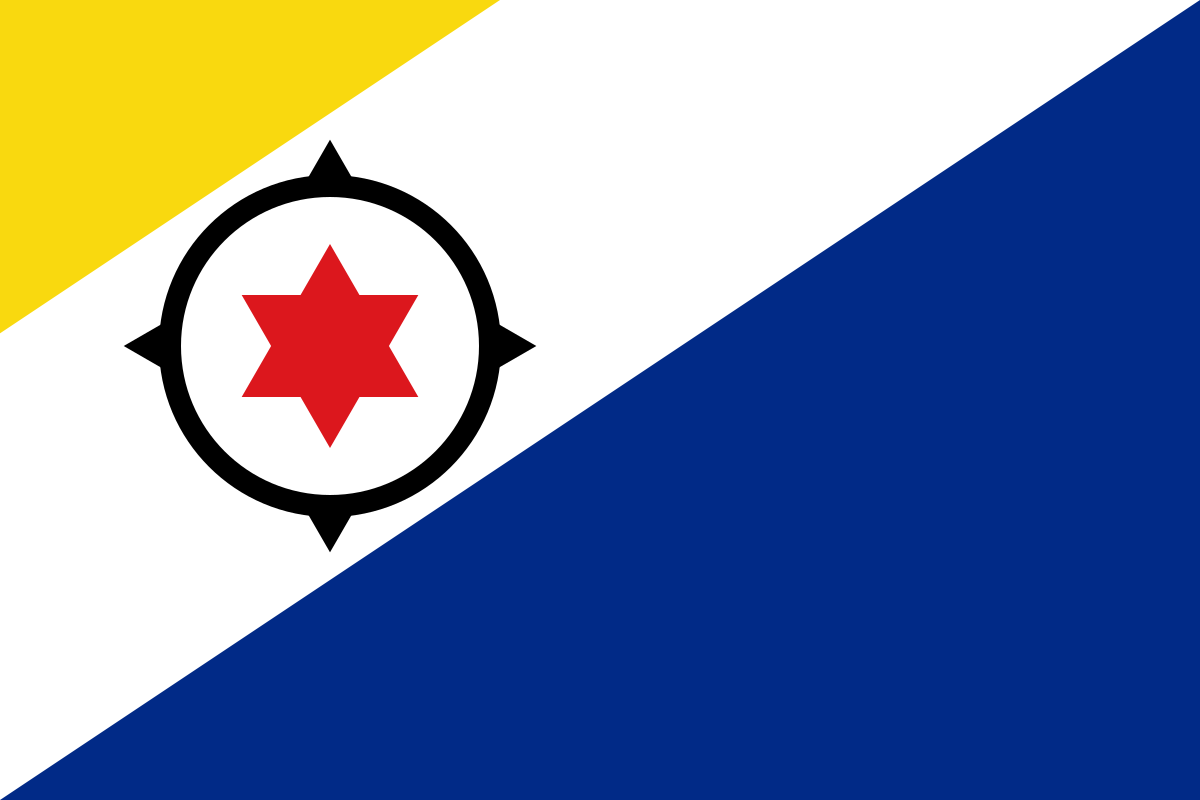

Scotiabank Bonaire

Bonaire MCB

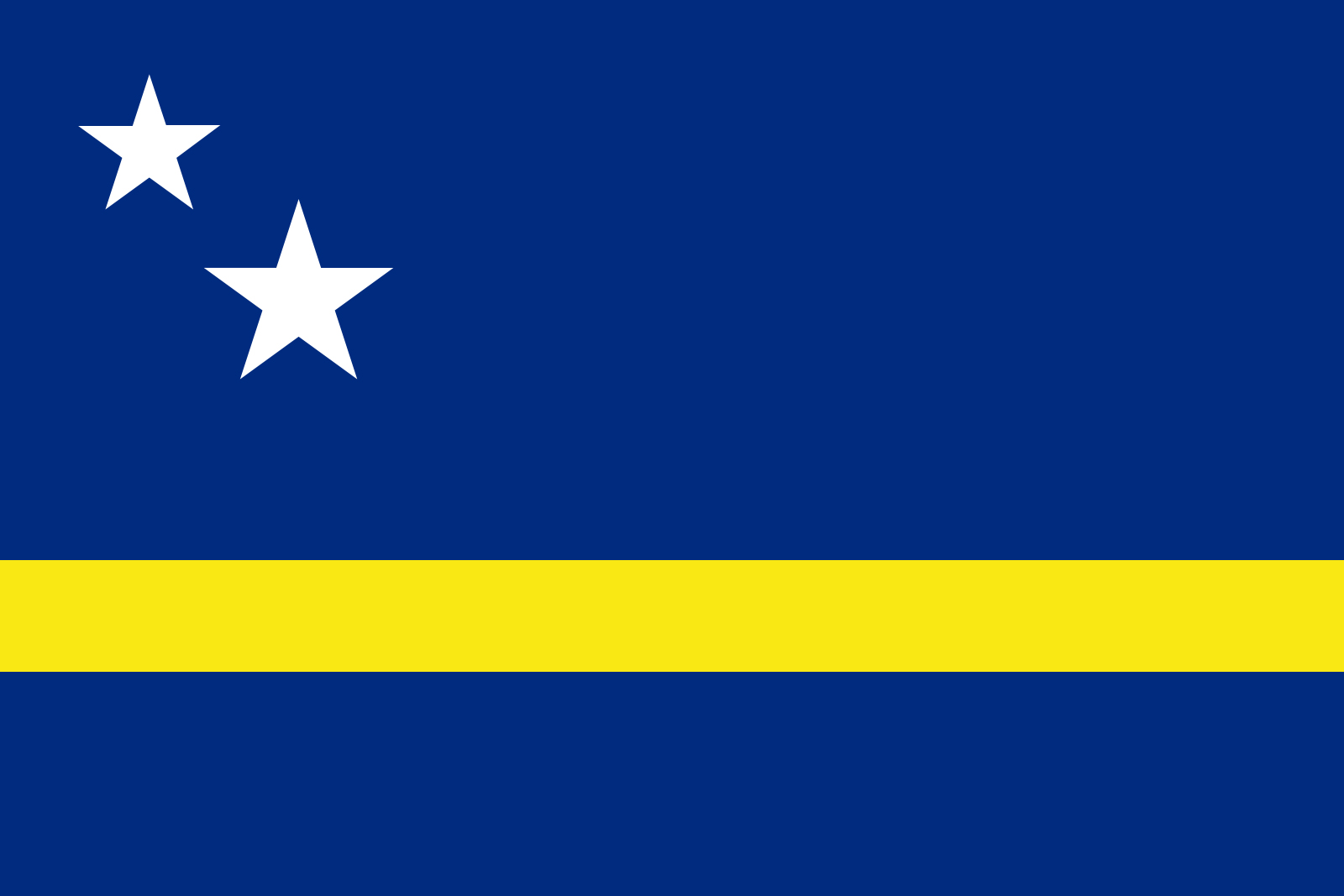

MCB Curacao

Curacao MCB

MCBCOUNTRY

BANK

Dominica

Dominica Scotiabank

Scotiabank Dominican Republic

Dominican Republic Banco del Progresso

Banco del Progresso Dominican Republic

Dominican Republic Banco Popular Dominicano

Banco Popular Dominicano Grenada

Grenada Scotiabank

Scotiabank Guyana

Guyana Scotiabank

Scotiabank Jamaica

Jamaica Scotiabank

Scotiabank Panama

Panama Credicorp

Credicorp St Croix, USVI

St Croix, USVI Scotiabank

ScotiabankCOUNTRY

BANK

St Kitts/Nevis

St Kitts/Nevis Scotiabank

Scotiabank St Lucia

St Lucia Scotiabank

Scotiabank St Maarten

St Maarten Scotiabank

Scotiabank St Vincent

St Vincent Scotiabank

Scotiabank St Thomas, USVI

St Thomas, USVI Scotiabank

Scotiabank Suriname

Suriname DSB Suriname

DSB Suriname Trinidad & Tobago

Trinidad & Tobago Scotiabank

Scotiabank Turks & Caicos

Turks & Caicos Scotiabank

Scotiabank